United Way of Indian River County is calling on community members to make a meaningful impact this tax season by volunteering with the Volunteer Income Tax Assistance (VITA) program.

VITA provides free, reliable tax preparation for individuals and families earning $68,000 or less, helping them access critical refunds and tax credits such as the Earned Income Tax Credit, Child Tax Credit, and American Opportunity Tax Credit – which can make a significant difference for working families and students.

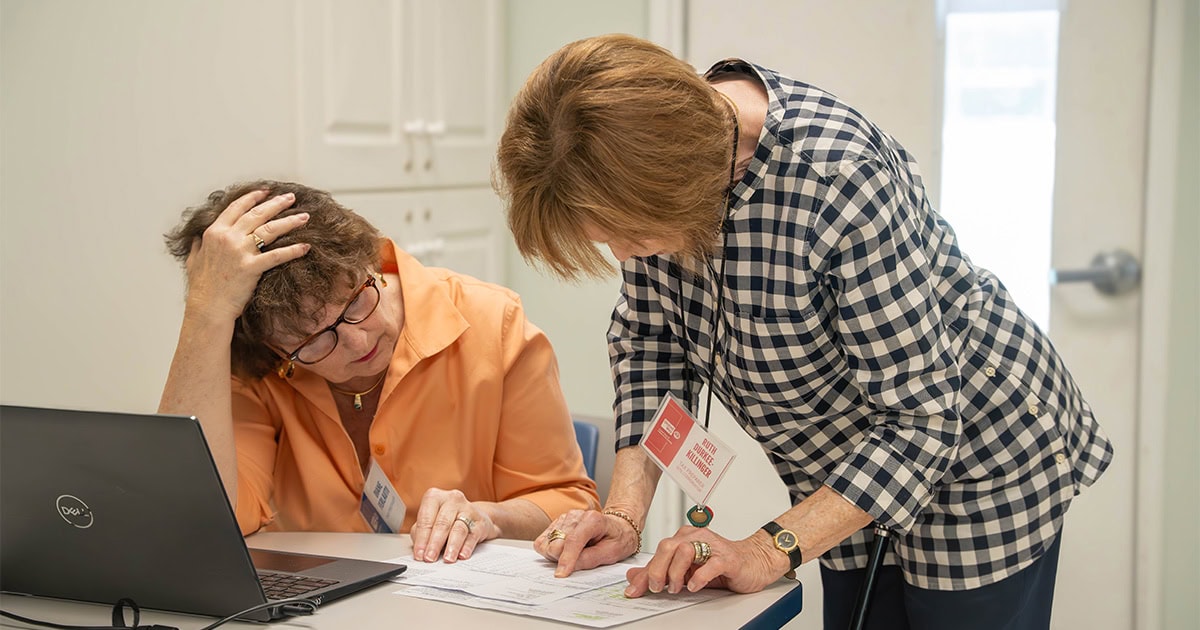

Volunteers receive free IRS training and certification, flexible schedules, and ongoing support from United Way staff. No prior experience is needed – the program uses intuitive software and offers step-by-step guidance. Volunteers also gain valuable skills in finance, customer service, and community engagement, and eligible participants can earn Continuing Education Credits.

“These volunteers make a remarkable difference for families and individuals in need, and we couldn’t be prouder of their dedication,” said Meredith Egan, Chief Executive Officer of United Way of Indian River County. “As we look to the coming year, we’re calling on even more passionate individuals to join us in this rewarding work.”

VITA sites will operate at multiple locations across the county from mid-January through April 2026. Volunteers will be required to attend a three-day training session at the United Way Center (9:00 AM – 3:00 PM, dates to be announced).