The COVID-19 pandemic has taken a financial toll on households throughout the country, Indian River County included. But thanks to United Way of Indian River County’s Volunteer Income Tax Assistance Program (VITA), over a thousand households received the tax credits they deserved.

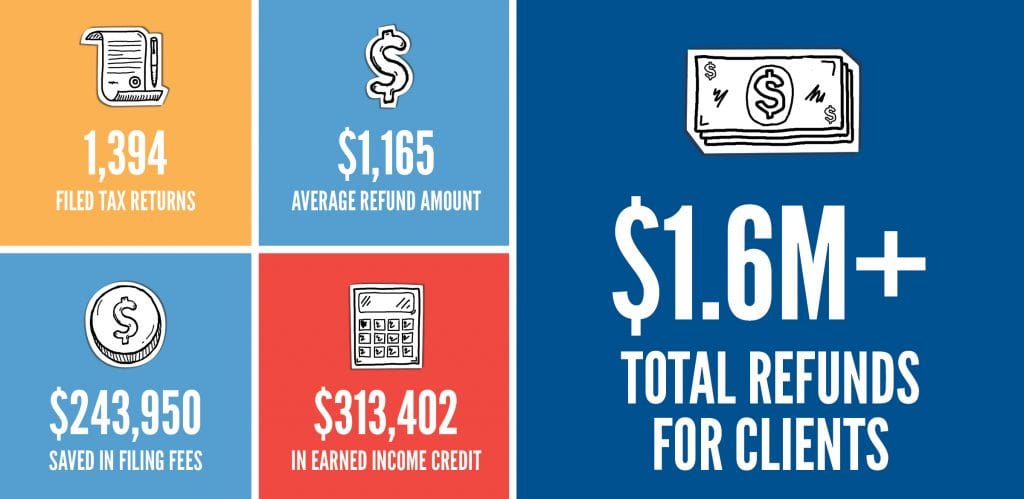

As the area’s only free site for the 2021 tax year, the Valet VITA program, a drop off service, allowed clients to drop-off their taxes and pick up their completed return with ease. For Indian River County residents, maximizing this year’s tax refund is crucial and can help a household survive. Twenty-seven IRS-trained and certified volunteers ensured taxpayers received all of the credits for which they were eligible and helped put over $1.6 million back into the pockets of residents.

“We pride ourselves in being there for our community in times of sunshine and storms. Many of our clients needed some good news, and we were happy to provide them with a little sense of relief,” said Meredith Egan, Chief Executive Officer. “This is just one of many resources and tools United Way champions to help people in our community achieve financial stability.”

Since 2009, United Way has partnered with the IRS to provide the Volunteer Income Tax Assistance Program (VITA). This program is offered annually from January through Tax Day to assist families and individuals with low to moderate incomes prepare their tax returns for free. With no cost to clients, households could save an average of $175 in tax preparation fees.

“The dedication of staff and volunteers, even throughout the pandemic, is a true testament for what it means to LIVE UNITED. Despite having to reconfigure our traditional way of filing taxes, our team was able to effortlessly pivot and adapt to continue this vital service. While other free tax programs weren’t taking clients, we stayed true to our roots to make a lasting difference in our community,” said Meredith Egan.

Concluding on May 17, the VITA program filed a total of 1,394 tax returns, with an average refund of $1,165 per household. Indian River County residents received $313,402 in Earned Income Tax Credits, $204,452 in Child Tax Credits, and $14,829 in Education Tax Credits. While many families are counting every penny to pay for essentials, they can now use this money to purchase groceries, cover rent or mortgage payments, or rebuild emergency savings.

This program would not be possible without the local sponsors helping to cover the costs of this service; Kmetz, Elwell, Graham, and Associates PLLC; and Morgan, Jacoby, Thurn, Boyle, and Associates, P.A., and the IRS-certified volunteers who generously contribute their time.

If you would like to learn more about becoming a VITA volunteer or sponsor, please contact Stacy Benezra, Community Impact Coordinator at (772) 567-8900 or gro.CRIyaWdetinU@arzeneB.ycatS.

About Volunteer Income Tax Assistance (VITA) Program

The VITA program is a free tax preparation service focused on members of our community in the ALICE population. ALICE stands for Asset Limited, Income Constrained, Employed, representing households living paycheck to paycheck and unable to provide basic necessities for themselves or their families. The most recent ALICE report released by United Way revealed that 44% of IRC households are considered ALICE or live below the poverty level.

About United Way of Indian River County

United Way of Indian River County (UWIRC) is a 501(c)(3) non-profit organization that fights for the health, education, and financial stability of every community member. United Way works with local programs to provide resources to individuals and families in crisis today, while working year-round to improve community conditions and create lasting solutions. We are effectively building a strong foundation and improving lives by mobilizing the caring power of our community. For more information about your local United Way, please call (772) 567-8900 or visit our website, UnitedWayIRC.org.